Is a Qualifying Charitable Distribution (QCD) Right for You?

By Skip Helms, Asheville Habitat Legacy Builders Society Member, former Asheville Habitat Board Member, and President of Helms Wealth Management, LLC

As the end of the year approaches, we want to proactively thank you for considering Asheville Area Habitat for Humanity in your giving budget. We appreciate your generosity and will always use your gifts wisely.

Donors over the age of 70 ½ now have some new opportunities. For many years, the tax code has allowed people over that tender age to transfer up to $100,000 a year from their Individual Retirement Accounts (IRAs) to qualifying charities like Habitat. The gift is a direct pass-through. The charity gets all of the money and there are no taxes due.

People over 70 have to take Required Minimum Distributions (RMDs) from their account every year. If you transfer some or all of that mandatory withdrawal to a qualifying charity, it isn’t considered taxable income.

The provision is called the Qualifying Charitable Distribution (QCD) and donors have been using it for some time now. Recent tax law changes just made it much more important.

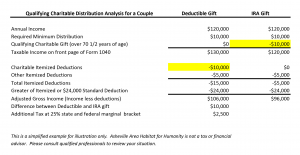

The standard deduction has doubled from $6,000 to $12,000 per person or $24,000 for couples. That’s good news. Only about 5% of Americans will still itemize their deductions this year.

Donors over age 70 can increase their tax savings by carefully choosing which account to use for gifts. They still have to take required IRA distributions. If they will be better off using the standard deduction and not itemizing their charitable gifts, giving through their IRA keeps that portion of those withdrawals from becoming taxable income. It’s almost like deducting it twice by checking a different box on the distribution form. Here’s a short example:

You only ever own most of an IRA. The government owns the rest. You have to pay them their share when you spend it, or your family has to pay them later. But if you give your portion to charity, you can give them the government’s money too.

That makes IRAs attractive for current giving. It makes them great for legacy planning since your family will get an updated cost basis on your other assets.

Asheville Area Habitat for Humanity can do wonderful things with your generous gift but we are not financial or tax planners. We encourage you to speak with qualified advisors who know your situation. Please call Kit Rains at 828.210.9365 to let us know how we can help.

Thank you again for thinking of Asheville Area Habitat for Humanity and we hope you will forward this link to friends who have questions about supporting Habitat or other great organizations.