Where Habitat Fits in the Movement for Racial Equity

By Andy Barnett, Executive Director

Earlier this week, we observed the Martin Luther King Jr. Holiday. The holiday provides an opportunity to reflect on the legacy of Dr. King and to recommit to a vision of equity for our neighbors who face barriers due to intentionally discriminatory policies and structures of power. Dr. King saw a great deal of progress toward racial equity in his lifetime and we have seen more in the years since his death. But much remains to be done to realize the dream of a nation where everyone has the chance to live up to their potential regardless of where they start from and the obstacles in their path. Continuing this work is our challenge today.

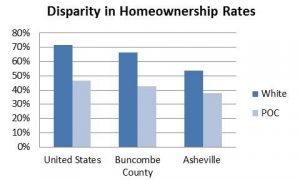

Homeownership Disparity; Source: U.S. Census Bureau, 2011-2015 American Community Survey 5-Year Estimates

One of the places where we haven’t seen progress toward racial equity, where, in fact we see a widening gap between whites and people of color is in household wealth. In 1963, the disparity in median family wealth was about $40,000; white households now have a median net worth $123,000 higher than African American families according to a report by the Urban Institute. This means that white families are much more able to weather financial hardships, take advantage of education and career opportunities, and participate in a virtuous cycle where the wealth attainment of one generation becomes the platform for the next. Families of color are much less likely to see these benefits.

A number of factors contribute to the widening gap in wealth including income, employment, family wealth, and education attainment. But, the largest single factor is homeownership—accounting for more than 25% of the disparity according to a Brandeis study. White households are more likely to own homes. In Buncombe County, 72% of white households own their home while fewer than half of households of color are homeowners. This level of disparity in homeownership is consistent with national homeownership gap. Not only are households of color less likely to own homes, they also build equity more slowly (and lose it more quickly) than white households.

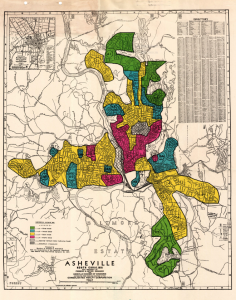

Home Ownership Loan Corporation “redlining” map of Asheville

This disparity is the result of intentional real estate and mortgage lending practices. Beginning in the 1930’s, federal underwriting policy established lending risk based on geography. Communities of color were identified as having a greater risk of default. As a result, these “redlined” areas were largely excluded from the post-war housing boom in housing development finance. Across the country new developments legally excluded Black and Latino buyers through restrictive covenants, and at the same time, neighborhoods of color declined due to lack of capital investment.

This pattern of lending created, in effect, two housing markets. One that rapidly appreciated in value and was restricted to whites, and another for people of color where values and conditions stagnated or declined. Overtime the deteriorating conditions in these disinvested neighborhoods “proved” that race-based lending practices were justified and these neighbors were blamed for the poor conditions rather than recognized as victims of discriminatory practices. Even after housing discrimination based on race was outlawed, “blight” and a “blame the victim” culture made it easy to justify redevelopment and displacement. Unfortunately, two generations of households have missed out on wealth building through a period of historic home value appreciation.

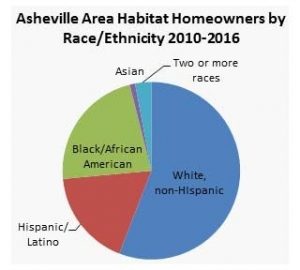

This is where Habitat’s work enters the story. We are a builder and a bank. Our programs simultaneously address geographic disinvestment and create a path to successful homeownership. Habitat develops housing in neighborhoods that other developers might reject, but where opportunities exist for a good quality of life for homeowners. Depending on the market, Habitat’s investment can boost a stagnating market or build long term economic integration in a “hot” market. By financing and assisting repairs for existing homeowners, Habitat preserves the housing stock and adds value to existing neighborhoods. Habitat lends to first time buyers and finances repairs for existing owners that other lenders have determined are too “risky”. Through careful underwriting, extensive education, a focus on partnership with the borrower, and a commitment to affordable mortgage terms, Habitat successfully extends homeownerships to households with incomes well below what it would take to qualify for a conventional mortgage. Since 2010, 45% of those new homeowners were households of color.

Habitat creates a way for households facing economic barriers to achieve homeownership and begin to close the wealth gap, but we can’t do it alone. To achieve equity in rates of homeownership nearly 3,000 additional households of color in Buncombe County will need the opportunity to become homeowners. To achieve this scale, we will need many more lenders to adopt policies that help households of color overcome historical barriers to mortgage loans. We need to grow housing and financial counseling opportunities to help aspiring homebuyers become “mortgage ready”. We need more affordable rental options and tenant advocacy so that renters have the stability needed to save and prepare for future ownership. Finally, we need home repair and foreclosure prevention assistance to help existing homeowners to remain at home. In short, it will take everyone committing to give our time, our financial support, and our voices to advance the dream of equality of opportunity for all our neighbors regardless of race.

Habitat creates a way for households facing economic barriers to achieve homeownership and begin to close the wealth gap, but we can’t do it alone. To achieve equity in rates of homeownership nearly 3,000 additional households of color in Buncombe County will need the opportunity to become homeowners. To achieve this scale, we will need many more lenders to adopt policies that help households of color overcome historical barriers to mortgage loans. We need to grow housing and financial counseling opportunities to help aspiring homebuyers become “mortgage ready”. We need more affordable rental options and tenant advocacy so that renters have the stability needed to save and prepare for future ownership. Finally, we need home repair and foreclosure prevention assistance to help existing homeowners to remain at home. In short, it will take everyone committing to give our time, our financial support, and our voices to advance the dream of equality of opportunity for all our neighbors regardless of race.

P.S. – On MLK Day, a group of Habitat staff members and volunteers watched this 30 minute film together to gain a better understanding of the complex roots of today’s racial inequity in housing. I encourage you to make the time to watch it.